What to Do If You See or Involved In a Hit-and-Run Accident

Public Records Resistance in Iowa

Access to public records is a fundamental right in many parts of the world, essential for transparency and accountability. In Iowa, however, there are increasing concerns about resistance to releasing certain types of public data, especially regarding traffic enforcement records, such as those from speed cameras and red-light cameras. Understanding the challenges surrounding public records in Iowa can help residents, journalists, and advocates push for more transparent practices. This article explores the barriers to public records access in Iowa, why these records are crucial, and how the state compares with others on this issue.

Why Public Records Matter in Iowa

Public records are essential for government transparency, giving the public insight into how taxpayer money is used and providing accountability for government actions. In Iowa, traffic enforcement records—such as data from red-light and speed cameras—can help the public understand enforcement patterns, assess traffic safety programs, and hold institutions accountable for the use of automated traffic cameras.

Access to these records allows Iowans to:

- Verify enforcement accuracy: Errors in traffic citations can be challenged when records are accessible.

- Hold public agencies accountable: Review agencies’ spending on traffic enforcement, especially in areas where automated cameras are in use.

- Evaluate public safety effectiveness: Determine if red-light or speed cameras actually improve road safety or if they disproportionately generate revenue without substantial safety benefits.

Challenges to Public Records Access in Iowa

Despite these benefits, Iowa has seen resistance from some government agencies in releasing public records. Here are some key challenges to accessing this information:

-

Privacy Concerns

- Iowa agencies cite privacy as a primary reason for restricting access to traffic enforcement data. While privacy protection is essential, Iowa’s laws sometimes overly restrict information, leaving residents unable to assess how public resources are used.

-

Cost of Access

- In many cases, obtaining public records can incur high fees, often justified by the need to cover the time and labor required to produce the information. These costs can deter ordinary citizens from accessing data and reduce public scrutiny.

-

Lack of Transparency in Record-Keeping

- Record-keeping practices can sometimes be inconsistent or lack transparency, making it difficult to track down specific information. When agencies aren’t required to provide detailed reports, it leads to inconsistencies in data accessibility.

-

Limited Resources for Records Requests

- Agencies often claim limited resources to handle records requests in a timely manner. This results in delays that can take weeks, months, or even years, effectively rendering some data unusable for time-sensitive investigations or reports.

How Iowa’s Public Records Resistance Compares with Other States

Public records laws vary widely across the United States. Some states have robust systems in place to ensure data accessibility, while others, like Iowa, place significant hurdles before citizens. Here’s how Iowa compares with other states:

- Stricter Regulations: While states like California have relatively accessible public records laws, Iowa has stricter regulations that can hinder transparency, particularly around automated traffic enforcement data.

- Higher Fees for Access: States like Texas offer many public records at minimal costs, making it easy for residents to access data. In Iowa, however, fees can sometimes be prohibitively high.

- Lengthy Processing Times: States with better funding and streamlined procedures, like Washington, allow for quicker processing of public records requests. Iowa's process, however, can take significantly longer, adding frustration for those seeking timely data.

Potential Solutions for Improving Public Records Access in Iowa

-

Revisiting Privacy Laws: Updating laws to maintain a balance between privacy and transparency can ensure that the public gets access to essential information without compromising individual privacy rights.

-

Standardizing Record-Keeping Practices: By implementing standardized record-keeping practices across all agencies, Iowa can reduce discrepancies and improve data consistency, making it easier for residents to locate information.

-

Streamlining the Request Process: Simplifying the request process through online portals and efficient systems can speed up response times and reduce bureaucratic red tape.

-

Reducing Access Fees: Lowering or eliminating fees for public records requests, especially for journalists and researchers, would encourage transparency and public oversight.

-

Implementing a Digital Database: Iowa could establish a centralized digital repository where non-sensitive public records are available on demand, without needing to request them individually.

Why Public Records Matter to Iowa Residents

Ultimately, public records serve the public’s interest by promoting government accountability and transparency. For Iowans, having access to enforcement data can shed light on traffic safety initiatives, guide public opinion on automated enforcement, and influence local and state-level policy decisions.

Conclusion

While Iowa faces challenges in providing transparent access to public records, particularly in traffic enforcement, progress can be made with targeted reforms. Balancing privacy with transparency, reducing fees, and improving response times are all achievable goals that would bring Iowa closer to an open-access model. By addressing these issues, Iowa can ensure its citizens have the information they need to make informed decisions and hold government agencies accountable.

Unlicensed, Uninsured, and Unregistered Driver Accident: What To Do

Accidents are stressful under any circumstances, but when the other driver is unlicensed, uninsured, and using fake plates, the situation can become even more complicated. Here's a comprehensive guide on what steps to take if you find yourself in such a predicament.

Auto Insurance: 8 Clever Ways Texans Can Bring Down Their Premiums

Car insurance premiums can be one of the most expensive parts of being a car owner. Auto insurance is required throughout most of the US, and Texas is no exception. In the event of an accident you cause, Texas law requires you to be able to pay for all of the damages incurred. For most Texans, taking out insurance is a simple and hassle-free way to ensure they meet this legal responsibility.

It is important not to prioritize cost over quality when

it comes to auto insurance. The best car insurance can protect you in a wide

range of scenarios and can provide you with invaluable aid if you get injured

in an accident yourself. Still, it makes good financial sense to do what you

can to bring down premiums when possible.

Buy The Right Vehicle

Some cars are cheaper to insure than others, so if

you’re due an upgrade for your vehicle, consider looking at options that will

cut back on your premiums. You can find plenty of lists online of the cars that

are cheapest to insure, or you could check the quotes you get from price

comparison sites to see the benefits yourself. Things that impact a

car’s insurance costs include the cost of the car, how

expensive it is to repair, and its safety record.

Avoid Unnecessary Driving

The more you drive, the higher your insurance premiums

will be. This is because the more time you spend on the roads, the higher the

likelihood of you experiencing an accident. While cutting back may not be

possible for many Texans, those based in major urban or suburban areas could

cut back on driving and take public transport instead. You could also try

walking or cycling more often and add a little health bonus to the money

saved.

Make Use Of Multi-Car Discounts

If you have multiple cars that need to be insured at

once, you could benefit from a multi-car discount from your insurer. This is

essentially bulk buying in insurance, and many providers offer it as a way to

entice larger families or people with multiple cars to their business. Check

out the quotes you get for insuring one car against insuring two or three to

see what kind of savings you could make.

Join The AARP

Some insurance providers offer discounts to members of

certain groups. One great example of this for Texans is The Hartford, which

provides car

insurance Austin TX at a 10% discount for AARP

members. Not only do The Hartford provide excellent value for money, but their

AARP insurance has a range of benefits in coverage that could benefit any

driver over 50.

Shop Around For The Right Provider

Shopping around should be a staple for any smart

financial choices you make. Many insurers will offer incentives for you to

bring your business to them, such as discounts or freebies that come with the

policy. Check regularly to see what kind of offers there are for the insurers

you’re considering but be careful to think it through and not give in to

impulse purchasing or pressure tactics. You could also talk to your current

provider to see if they can match quotes you’ve received elsewhere.

Pay In One Go

Paying your insurance premiums in one go is almost

always cheaper than paying monthly. Unfortunately, this is one of the catch-22s

of buying insurance, as people often opt for monthly payments because they

can’t afford to pay for the policy outright. It might help to start saving as

soon as you take out your new policy and try to pay in one go when the

insurance renews.

Increase Your Deductibles

The more you pay in deductibles, the lower your

insurance premiums will be. Of course, the higher your deductibles, the more

you will have to pay out of pocket if something does happen. You should think

carefully before using this option, as you’ll normally see the benefit if you

increase deductibles from $250 to $1,000. If you do this, it is vital that you

have sufficient savings to cover the $1,000 deductible so that you aren’t left

in debt or on the wrong side of Texan law.

Take A Defensive Driving Course

Defensive driving courses can help you to become a

better and safer driver, making you a lower risk in the eyes of your insurance

provider. There are plenty of defensive driving courses available to help you

manage emergency driving situations safely. You can even take these

courses online, though you should check with your

insurance provider to ensure that they accept the course you take.

Conclusion

There are plenty of options available for Texans who want

to bring down their car insurance premiums without sacrificing the quality of

their coverage. You’ll need to be strategic about your insurance and take steps

to make yourself a lower risk in the eyes of insurance providers. It is also

crucial to shop around until you find a provider with the right benefits and

value for money to make your insurance investment worthwhile.

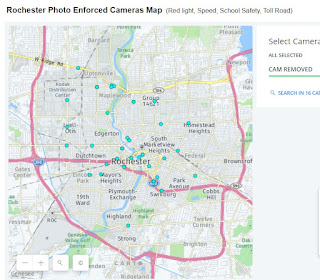

Map of Rochester, New York Red Light Cameras Removed

Adulting 101: Understanding Car Insurance

Hi, just your fellow aging millennial checking in here to make sure you haven’t sped past learning car insurance on your adulting journey. Are you running smoothly, or is your insurance-education check engine light flashing?

Whether you’ve been driving for over a decade or just starting, understanding car insurance is necessary as you become

an adult. Knowing that you have to pay for it and using a car insurance comparison guide to

find the least expensive options isn’t enough if you have no idea how to use

it properly.

Life is expensive enough, so you don’t

need to pay for more than what you need or spend more than required.

Understanding car insurance will help you negotiate better deals and ensure

that you utilize whatever policy you have to its full potential.

What are the parts of an auto

insurance policy?

Every basic policy will include a variation of

six features that outline your coverage. A list of each feature you need to

ensure a well-rounded policy that will give you the most protection and savings

is:

Liability Coverage

We all make mistakes, which is why liability coverage is probably most crucial when designing a policy. Having liability insurance ensures you and anyone you allow to operate your vehicle in case of an accident.

Since this is fault protection, how much liability coverage drivers have to purchase to be insured on the road can be set by your state law. Liability coverage is made of two parts to help protect you from needing to come out of pocket for another driver’s injuries or damage vehicle.

Bodily injury liability is designed to cover costs related to a person's injuries. In contrast, property damage liability helps protect the financial need to fix any damage you’ve caused to someone’s vehicle. This coverage is mandatory in almost all states.

Bonus Insurance Tip — Always know what your liability limit is before agreeing to a policy. This limit will tell you the value of the maximum amount your insurer will pay if you are at fault for an accident.

The most basic coverage most use to compare

the quality of their deal is called "25/50/25" coverage. This means

that your policy will pay up to $25,000 per injured person, up to $50,000 per

accident, and at least $25,000 in property damage.

Uninsured and Underinsured

Motorist Coverage (UIM)

Serves as financial protection if you are hit by a driver who doesn't have insurance, whom you cannot identify (hit-and-run), or whose insurance has lapsed.

In some states, UIM coverage will pay for your medical bills as well as the cost of vehicle repairs, which is vital when you can’t hold another insurer responsible.

This coverage also comes into effect if you

are hit by a driver whose liability limits aren't enough to cover bills caused

by the accident. UIM is required in some states but optional in others.

Collision Coverage

Car accidents are common, and the last thing you’ll want to stress about is how you’ll pay for damages. After being involved in an accident with either another vehicle or an object, collision coverage will guarantee you financial help that will recover or repair your car.

This kind of coverage is ideal to have

included in your policy because it covers you regardless of who is at fault.

Collision coverage is not required and is optional in most states.

Comprehensive Coverage

Those funny sketches show moments where a tree branch or something crazy ruins a character’s car isn’t so amusing when it happens to you. For those unpredictable and unavoidable moments, there is comprehensive coverage.

With this, if you experience non-collision damage from an external non-fault factor such as natural elements, vandalism, flood, fire, or theft, your car is covered. Comprehensive coverage is valuable because it can aid in paying for repair costs or even replace your entire vehicle up to its full cash value.

Please note that this coverage typically has a

deductible, which is the dollar amount you'll have to pay before your insurer

reimburses you the claim. Comprehensive coverage is optional but may be

required to lease a vehicle.

Medical Payments Coverage

Protects you if you, a family member, or a passenger need to file injury claims after an accident. Medical

payment coverage is necessary coverage to help cover any costs associated with

injuries you or your passenger gets while in your vehicle.

A few examples of what medical payments are covered include hospital visits, surgery, X-rays, and more. Though Medical coverage is wise to have it is only required in some states and is optional in others.

Personal Injury Protection (PIP)

or No-Fault Insurance

Both personal Injury protection (PIP) and medical payment coverage pay for most medical and funeral expenses.

This policy is used to help cover any bills that accumulate because of injuries obtained during driving. This policy is a preferred coverage option because it will cover expenses other auto insurance policies don’t.

PIP will help cover expenses such as child care, household expenses, and physical therapy. Though the policy’s title is “personal injury,” this protection also ensures coverage for passengers that may become harmed or killed while traveling in your vehicle.

Another PIP benefit is that it will help recover lost income due to an accident. PIP coverage is required in some states and optional in others.

You can decide which policies you need, more

or less depending on what you need, what you can afford, and for how long you

need your policy.

What to Know About Applying for

Car Insurance

The easiest thing about car insurance is finding it. Companies want your business and are dying to tell you, in detail, about all, they can offer.

Before looking at a price and signing an agreement, shop around and vet your agent just as much as you are your deal. Stay mindful about what deals are currently available to you as well as the realities of your application.

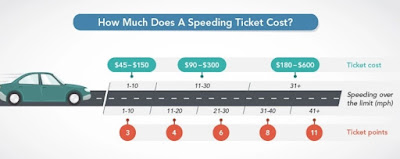

Advertisements may be intriguing with cheap rates, but go over the details with a fine-tooth comb to make sure you’re not sacrificing pennies now for thousands of dollars later on. If you have poor credit, accumulated tickets that affect car insurance, or live in a city that requires high liability, expect higher premium quotes.

Understanding insurance can be intimidating, but it is simply an agreement between you and a provider for financial protection for unexpected expenses for whatever accidents may come your way.

Car insurance is one adulting responsibility

of many, but if used correctly it can help you maintain and gain more control

over your life.

A Closer Look at SR-22 Insurance Cover

It is expensive and stressful to deal with a legal case after being arrested or having your license suspended for a DUI. Obtaining a letter from your state's Department of Motor Vehicles directing you to collect your SR-22 document is even worse.

First-time offenders have a difficult time

getting to know the definition of the term SR-22 Insurance. Also knowing its

use is a challenge for all first-time offenders.

What is an SR-22?

It can also be called an SR-22 bond, SR-22

insurance, an SR-22 form, or a Certificate of Financial Responsibility.

It is proof that you have the minimum required liability auto vehicle insurance that is required in that state-Once you have provided this certificate, the authorities will notify the State's Department of Motor Vehicles that you have what is required and financially responsible to drive in that state.

Uses of A SR-22 insurance.

Despite being commonly associated with DWI

offenses or DUI offenses, there are other occasions when an SR-22 license will

be required. They include:

1-After being involved in a reckless driving

instance.

2-When caught driving a car without the right

insurance cover.

3-When your license has been revoked or

suspended.

4-When you have been involved in multiple

violations or at-fault accidents.

5-Repeated traffic offenses.

How To Get An SR-22 Certificate.

If you are in possession of an insurance

cover, you can consult your insurance service provider on the requirements

needed to add the SR-22 policy to your existing insurance cover.

Not every insurance company offers SR-22 insurance. This will help those that are new in the market when looking for an insurance company to join or seek insurance services such as SR-22.

The insurance company after adding your new cover will get in touch with your state to file the SR-22 form. To expedite the process, the insurance company can opt to file the form electronically instead of by mail.

How Much Does An SR-22 Cost?

In most states, the filing fee for SR-22

insurance costs around $15-$25 dollars. As long as the insurance policy hasn't

expired, the fee is paid only once and will only be renewed after the insurance

policy has expired-after three consecutive years.

Drivers that need the SR-22 insurance are

charged more than the other drivers since they are considered high-risk

targets. The filing fee is however much cheaper than the SR-22 fee.

Different rates are charged by different companies to individuals who go looking for an SR-22 license. To get the best rates, it is advisable to get a list of all insurance providers and compare their SR-22 rates. You will be able to pick a policy that is affordable and that best suits your needs.

How Long Does An SR-22 Insurance Last.

A driver is required to maintain an SR-22 file

for three consecutive years. Different states have different SR-22 requirements

but three years is the average time.

An insurance company is required to inform the DMV in case there is an interruption on the insurance cover. This subsequently means that you are no longer in compliance and hence not insured.

Failure To Maintain An SR-22 Insurance Cover.

Failure to make a payment or cancel your

insurance policy during the three years has some repercussions. Normally you

should hold onto your non

owner SR-22 car insurance for three years.

Some of the repercussions of canceling an

SR-22 Insurance cover includes:

1-The suspension of your vehicle registration.

2-The suspension of your license.

3-More money to pay for the extra fines.

4-Extra fees for registration and reinstating

your insurance policy cover.

5-Higher premiums when purchasing new

insurance covers.

When holding an SR-22 be sure to practice safe

driving measures and follow all driving guidelines provided by the State to

prevent you from paying fines, being arrested, or having your license suspended

or revoked.

Good driving behavior will help improve your

insurance premiums and also set you on a good driving record.

Ignoring the required terms will only cost you

more money and waste your valuable time.

For more details visit your state department office to get more information on the SR-22 regulations and get in touch with an insurance company.

How Where You Live Affects Your Auto Insurance Rates

Just like in real estate, location especially matters when renewing your insurance plans. If you’ve ever had to update your car insurance because of a move, you likely noticed a change in your monthly premium.

The way location affects car insurance is

not as simple as avoiding the country’s deadliest cities for drivers. To

keep from being surprised by rising insurance rates, continue reading to find

out what changes to look for in your town that could make you pay more for auto

coverage.

What factors influence your auto

insurance rates?

Driving is a risky activity, but many drivers go years without receiving a ticket or being involved in an accident by practicing safe driving. It is expected that drivers with a clean record are given the lowest insurance quotes possible, but elements outside of a driver’s control are just as influential.

Finding quotes for insurance coverage is a lot like adding and subtracting weights on a balance scale. A list of elements that are in little to no control of a driver is:

● Age: Unlike dating apps, you can’t lie about your age to insurance companies. Drivers under 25 and over 65 tend to have higher premiums due to inexperience and decreasing physical abilities.

● Gender and sex: This topic is somewhat taboo because most insurers ask for gender when data for comparing male and female drivers is done by sex.

For all drivers, insurers are likely to formulate insurance quotes based on an insuree’s license despite the way any initial forms have been filled. Because males tend to display riskier behavior behind the wheel, they tend to experience higher insurance rates.

● Credit score: Although you have some control, in most cases, a driver will always need insurance, making building a credit score before applying not always an option. When applying, insurers will pull a credit report, but you can request new rates from your insurer as your score improves.

● State regulations: States have different requirements for driving insurance minimums that influence base prices for premiums. Only two states (New Hampshire and Virginia) don’t require car insurance, but drivers are always held responsible for their driving and vehicles they operate or cause damage to.

● Where you park: Accidents can happen even when you’re not driving, which is why insurers consider what’s called your garaging address. Having covered private parking makes your vehicle less likely to be damaged or stolen.

For insurers, this means that having to cover damages due to weather, vandalism, or theft is at a lower risk. Those who live in cities usually utilize street parking, increasing their likelihood of filing a claim as opposed to drivers with private parking.

●

ZIP code: In addition to what state you’re in,

the ZIP codes of where you travel matters as well. If you live or work in

cities with heavy traffic or experience high crime rates, your premium will

increase due to the environment being considered high-risk.

What is the average rate for car

insurance?

The national average annual cost of car insurance is upwards of $1,400. Going by the average, most drivers with fair credit and driving records should expect to receive insurance quotes around $120 for a monthly premium.

Whether you pay more or less than the national average is mostly dependent on external factors like the ones listed above. Although not every aspect that affects auto insurance quotes is within your control, knowing how your location influences yours may help you negotiate a cheaper auto insurance rate.

Why Your Address Affects Auto

Insurance

If you’re looking for ways to conduct a quick move that save time and money, you should research the locational details before applying for new coverage. The most prominent factors in determining whether a location will raise a premium depend on these four things:

●

Traffic flow: Living in a big city comes with

price tags just about everywhere. Being in a heavily populated city provides

more chances for drivers to get into accidents, making every other driver

around you an additional liability.

●

Commuting mileage: Working in closer proximity

to where you live reduces your likelihood of getting into an accident. The

shorter your daily commute, the lower your monthly premium can be.

●

Harsh weather conditions: Those who reside in

states with harsh weather conditions tend to have higher base premiums than

those who live in areas with less dramatic seasonal changes. Experiencing harsh

weather conditions such as frequent rain, tornadoes, hurricanes, or snowstorms

affects a driver’s abilities and can threaten a vehicle’s condition.

●

Local crime rates: Crime rates don’t always

reflect the city’s size, which gets reflected in insurance rates. If your zip

code experiences high levels of auto theft, vandalism, or hit-and-runs, your

quotes are likely to be high despite your city’s population size.

What states pay the highest for

auto insurance?

If your mind is racing as to what cities do or don’t check these boxes, you’re not alone. Hopefully, that list hasn’t discouraged you from any plans to move, but the states that continuously have the highest rates include:

●

Florida: $2,587

●

New York: $2,498

●

Louisiana: $2,351

●

Michigan: $2,105

●

Texas: $2,050

● Rhode Island: $2,066

Where there’s high market competition between insurers and insufficient data for unregistered drivers, annual premiums tend to be cheaper. The states with the lowest annual auto insurance rates include:

●

Maine: $831

●

New Hampshire: $985

●

Ohio: $998

●

Wisconsin: $1,049

●

Idaho: $1,055

●

Iowa: $1,122

How You Can Get the Best Auto

Insurance Rates

Finding the best moving company should be at the top of your moving concerns, not needing new coverage. Doing your research can help you negotiate the best plan and keep you from paying for coverage you don’t need.

State regulations are designed to target the issues experienced in the area, but it can be frustrating to know that you’re paying more than someone else for the same service.

Every location has its pros and cons, but a few steps you can take to help you get the most affordable rates are:

●

Pick a car with high safety

ratings.

●

Practice safe driving habits.

●

Improve your credit score.

●

Take an advanced driving course.

●

Don’t take the first offer.

● Pay annually instead of monthly.

Danielle Beck-Hunter writes and researches

about auto insurance for the insurance comparison site, USInsuranceAgents.com. She is

passionate about helping people understand their options and save money on

their auto insurance.

Damages You Can Claim For After Being Involved In A Car Accident

While recovering from your physical injuries and even emotional distress after being involved in a car accident, one of the most daunting impacts for victims of vehicle collisions is the financial aftermath. Some of your financial considerations in a crash will include diminished value as your vehicle will likely be worth quite a bit less at the time of the accident compared to its original purchase price.

What's more, if you are purchased your vehicle with the help of vehicle finance or a personal loan, you will also have to consider the loan's interest. Recovering your damages from your insurance can be daunting, so to help you best list your costs, we have listed all the things you can legally claim after being involved in a car accident.

Diminished Value

Car insurance is undoubtedly essential, although policyholders almost always find themselves frustrated when in a position to claim from an insurer. Your insurer will likely attempt to settle for a low initial offer in most cases. However, it is vital to understand your policy and how to claim correctly to get the most out of your policy when you need it. A diminished value claim is a separate claim from your car accident claim. It is best to rely on legal representation when claiming from your insurer to solidify your case.

Property Damages

Property damages could be included in your car accident claim if you had any personal belongings in your vehicle that were damaged due to the accident. Property damages can also include property that was damaged as a result of the collision. This type of claim is handled separately from bodily harm claims.

Lost Wages

Suppose the impacts of the accident left you unable to earn an income for some time. In this case, you will be able to claim lost wages as damages that resulted from the car accident. However, you will need to provide valid evidence that you have lost income due to the accident, including a letter from your employer. Lost wages are usually quite straightforward to prove in a car accident claim, granted you have evidence from your employer as well as bank statements to solidify your missing income claim.

Medical Bills

One of the most common claims from victims of car accidents is medical expenses. However, if you have medical insurance that is covering your bills for you, you might not be able to recover medical costs. On the other hand, all you will need to prove this expense is the physical receipts from healthcare practitioners and any treatment recommendations for ongoing bills, and your diagnosis reports.

Emotional Distress

Claiming for emotional distress damages in a car accident claim is significantly more challenging than most other types of relevant damages. However, this is because it can be challenging to prove that emotional turmoil impacts the accident. Although you can claim for pain and suffering with the right medical professionals behind you and the correct legal representation caused the accident. Obtaining diagnoses such as post-traumatic stress disorder, anxiety, and others will be necessary to prove your experience was genuinely damaging to your mental health.

Contacting an insurance lawyer: Everything you need to know

Contacting insurance lawyers can be an intimidating thing to do. Not many people know quite what to expect in meeting an insurance lawyer, what you need to bring, and whether your case is a worthwhile cause. Well in this article, find out just when to contact an insurance lawyer, what you can contact them for, and what to expect from the process.

Should I contact an insurance lawyer?

One

of the most common questions about insurance claims is: Am I

eligible to make one?

This can be a tricky situation but, in most cases, if you have sustained an

injury that was not your fault, either at a workplace or out on the road, you

can make a claim.

Many

insurance lawyers operate within their own specialties ranging from accidents

at work, car crashes, accidents

between pedestrians and automobiles, all of which can be resolved through an insurance

lawyer. You just need to find the right one that suits your needs. Many out

there offer free consultations and can answer many of your initial questions

straight away.

What is the process of an insurance claim?

To

get the most out of your insurance claim and to ensure that it is paid swiftly

and easily, the more information you have the better. It is best to keep a

paper trail and evidence of each of the steps you make so that the claim can be

easily resolved.

One

of the first tasks is to report your accident as soon as you possibly can. The

quicker that you do this, the easier the process is. Whilst most states have a statute of

limitations of up to

two years on most accidents, it is not recommended that you wait that

long.

Documentation

Next,

you should document your losses as thoroughly as possible whether that be

through written lists, photographs, or a written statement about the event.

This way, the insurance company knows exactly what you are claiming for and the

value of the items.

Your

insurance company will likely give you claims forms to be filled out. Again,

use as much detail as possible to ensure that you receive the right amount of

compensation. Speed and accuracy are key again in this process. The quicker you

make your claim, the quicker it will all be sorted.

Offers and Settlement

Finally,

you should receive an offer from the insurance company, usually within the

writing. However, a key tip is to ask how long you need to wait for your offer

and set a deadline for the company. If you receive no response, pester them.

You have the right to your compensation and as such, you can and should push

for it.

Hopefully,

after these steps, you will receive your compensation as soon as

possible.

Unsuccessful claims

Unfortunately,

no guarantee can be made that you win your claim, and it should be noted that

in the event of losing, you are responsible for the legal

fees and repercussions.

However, if you follow the process above and select the correct insurance

lawyer, you should be in with a good chance.

Always remember knowledge is power! So, you should document everything you can to ensure your claim is successful. Contacting lawyers at the best of times can be scary but you have nothing to fear from a good insurance lawyer.

Top 3 Ways to Save on Auto Insurance

Are you paying too much for car insurance? I’m sure you’ve seen or heard ads from car insurance companies promising to help you save big. Often, they’ll mention bundling which is a great way to get a discount and save money. But there are so many other ways to save, too.

Did you realize that sometimes even your occupation qualifies you for a discount? Almost every car insurance company offers a military discount, and some even offer discounted car insurance for firefighters, EMS workers, and teachers.

Discounts are one of the best ways to save, but you can also pay less for car insurance by comparing quotes and switching to a company that offers your lower premiums. You can also tweak your coverage to appropriately cover your needs, which may help you save money.

Read on for some of the top ways for you to

save money on car insurance.

#1 – Discounts for Save on Your

Car Insurance

Almost every driver is eligible for at least one discount and many can earn several discounts. Each car insurance company sets up its own discount system, and the discounts listed below aren’t recognized universally.

Still, these are some of the most common car

insurance discounts.

Bundling Discount

If you purchase a homeowners, renters, boat,

or motorcycle policy from the same provider as your car insurance policy, you

will probably be able to get a discount. This discount is one of the most

common, and nearly every provider offers a percentage off of your premiums for

bundling.

Good Driver Discount

Good drivers tend to continue being good drivers. If you haven’t gotten into an accident in three years, you may be able to get a good driver discount. Insurance premiums are based on the risk you present to an insurance provider. Good drivers are low risk, so they usually get a discount.

Getting into accidents will affect your

eligibility for a good driver discount, and so will filing claims and getting

traffic tickets for things like speeding or running red lights.

Automatic Payments Discount

When you set up your payments to leave your

account automatically each month, you’re less likely to miss a payment and more

likely to stick with your current insurer, so they reward you with a discount.

Paperless Billing Discount

Paperless billing saves time and money for the

insurance company because they don’t have to physically mail bills to your

address, so they usually offer a small discount in return.

Low Mileage Discount

It makes sense that you’d pay less for car insurance if you drive fewer miles annually. The less time you spend on the road, the lower the risk that you’ll get in a crash and file a claim.

Obviously, insurance companies like that and

will incentivize that behavior.

Good Student Discount

Teen drivers pay the highest car insurance

rates of any age group. Most car insurance companies will offer a significant

discount for students who earn a 3.0 GPA or higher.

Driver’s Education Discount

A driver’s education discount is vital for teens because their car insurance rates are incredibly high, and they don’t usually qualify for many discounts. Find out which driver’s ed courses your car insurance company recognizes before investing in a class.

If you’re going to take a class, you might as

well get rewarded for it with a discount. You want a good driving instructor and program

that will help your teen drive safely, but you’ll want it to be recognized by

your insurance company so that you can get a discount for it.

Occupational Discounts

Military members can almost always earn a

discount. Some car insurance companies offer reduced rates for first responders

like firefighters, law enforcement, and EMTs. Teachers can sometimes find

insurers who provide a discount for their occupation, as well.

#2 – Comparing Rates to Save

Every six months, you should make a quote comparison. As your personal factors change with time, your current car insurer may not be the best. Some car insurance companies are a better fit with specific demographics.

You must realize that you may not be a good

fit with your current provider anymore as your demographics change.

Switching Car Insurance Companies

It doesn’t take much time to compare rates, and if you find a reputable insurance company where you can save significantly, you should take advantage and switch providers.

It’s crucial to compare identical coverage,

though. Don’t compare different coverage levels between companies because you

won’t get an accurate comparison. Make sure your deductibles and level of

coverage are identical, otherwise you may leave yourself open to unnecessary

financial trouble later.

Talking with Your Car Insurance

Company

Car insurance companies don’t negotiate

premiums. You won’t be able to talk them down to a lower rate, but what they

can do is help you evaluate your coverage, find discounts you may have missed,

or adjust your coverage levels to get your premiums more manageable.

#3 – Tweaking Your Policy to Save

Changing your policy can help you save a lot

of money. Just remember that you’ll pay less when you lower your coverage, but

you’ll also be eligible for fewer benefits.

Reducing Your Coverage

Reducing coverage will definitely help you save money on car insurance, but it’s vitally important not to leave yourself underinsured.

Suppose your car is over 10 years old, and you’re paying more than 10 percent of your vehicle’s value annually for full coverage. In that case, you’ll be better off dropping full coverage and carrying a liability-only policy.

Evaluate all the different types of coverage

you have. If you have coverage that will pay for a rental car should your car

be damaged, you could drop that option if you have a second vehicle or

transportation option.

Increasing Your Deductible

A reasonably standard deductible is $500.

If you raise that to a $1000 deductible, your monthly premiums will lower

significantly. Just remember that you’ll need to be prepared to pay that

deductible if you file a claim.

Switching to a Usage-Based Plan

Your car insurance provider may offer a different type of plan than standard insurance. If they don’t, you may want to consider switching insurers to one that does, especially if you don’t drive much annually.

A usage-based insurance plan charges you based on your driving. Some plans are by-the-mile where you pay a base monthly fee, and then you pay a set amount per mile that you drive.

Other usage-based plans use telematics devices

to monitor your driving habits, and the price is based on that information.

Be Proactive to Save the Most

There are many different ways that you can save on car insurance. None of them take much time, but you do have to be proactive. Your insurance company isn’t likely to call you up and offer you a discount.

It’s your responsibility to review your coverage and make sure you’re taking advantage of any available savings. Set aside an hour this weekend to look over your options. It shouldn’t take much longer than that, and the savings you can find are well worth the time.

Melanie Musson writes and researches for BuyAutoInsurance.com. She’s passionate about helping people understand their auto insurance needs and find the best fit for coverage without overpaying.What is your garaging address?

Many factors play a role in the insurance premium you are quoted when looking for the best car insurance. Plus, all the information you have to provide for a single application can be overwhelming.

Even an experienced driver who has paid

for auto insurance for years can find the process daunting. Providing your

insurance representative with the wrong information during the application can

affect your quote or can lead to legal issues down the road should you accept

the quote and start a policy with incorrect information.

Asking questions like “Can I insure my car at a different address?”

while applying for insurance with a provider can save you a lot of trouble down

the line since your garaging address plays a major role in the insurance rate

they give you.

Understanding what a garaging address

means for insurance companies and how it can affect you as a consumer can help

you find better car insurance rates and prevent you from unintentionally

providing incorrect information on your policy.

What exactly is a garaging address?

The concept of a garaging address can actually be pretty simple depending on your lifestyle factors. Your garaging address is the location where your car is parked most of the time.

If you have an apartment downtown near your job but have a permanent home in the country, you would put your garaging address where your car spends the majority of the time at.

So if you work and sleep at your downtown apartment Monday to Friday and go to your permanent home in the country on the weekends, your garaging address would be at your apartment because your car is parked there more.

For most people, their garage address is where

they live, but like the example mentioned above, it is not so simple for

everyone. Older individuals who are retired may travel a lot, so they may live

in more places than one. Their garaging address may change whenever they

relocate.

Why a Garaging Address Is

Important

Some may figure that as long as they are paying their insurance on time, then what does it matter what address they give their insurance company? Well, your insurance rate is directly affected by your garaging address.

Also, say you follow all the important steps to take after a car accident and your insurance provider sends a check for your claim in the mail to your garaging address. If they have the wrong address for where your car is parked most of the time, you may have to wait longer to receive funds to fix your car.

This type of situation can be extremely

frustrating if you moved to another city or state. This is why you should

always update your garaging address whenever it changes.

ZIP Codes Impact Insurance Rates

Your garaging address and the ZIP code connected to it are important because they determine your car insurance rate. Car insurance rates are based on where your car is located the most.

If your car is in an area that has high crime rates, your premium rate will be higher compared to if you live somewhere that is an urban or rural area with low crime rates.

Even having a garaging address in a city that has a higher population can increase your rates because it increases the chances of having a car accident.

It also increases the chances of your car being stolen or broken into because a higher populated area includes a wider range of different individuals with varied lifestyles.

Some other factors that impact your insurance rates are your date of birth, occupation, marital status, education level, driving history, and insurance history. Out of all of these factors, the most significant ones to auto insurance underwriters are your driving history, your age, and your car’s location.

Those are the most impactful factors because they directly affect the well-being of your vehicle. If you drive poorly, are young with little driving experience, or are regularly parking in a busy or crime-ridden area, insurance underwriters view you and your vehicle as a liability.

The extra money you pay for parking your car where it is most of the time makes up for the financial risk you pose to your insurance provider. Parking in a safer or less populated area can save you money with your insurance rate.

Another factor to consider with the higher premium rate for certain locations is the fact that red-light cameras are located in busier cities more often than rural and less populated areas. You are more likely to be caught doing something illegal while driving, whether or not intentional, in a crowded city than in a less busy area.

Too many traffic tickets display you as a

liability and more likely to get into an accident because you break the laws of

the road.

What is garaging

misrepresentation?

Garaging misrepresentation happens when you give the wrong garaging address on your car insurance policy. People partake in garaging misrepresentation unintentionally or intentionally, but no matter the reason, insurance providers take the misrepresentation seriously.

Unless you can prove the misrepresentation was a mistake, your provider could cancel your coverage, you could end up paying significant penalty fees, or you could face legal consequences.

Auto insurance companies in the United States lose around $3 billion every year because of garaging misrepresentation. So after you have started a policy, underwriters are usually required to double-check your address through various sources from time to time.

Misrepresenting your location can lower your

premium by around 35 percent, which makes doing it understandably appealing.

However, the consequences down the road can outweigh the immediate benefits.

How to Avoid Garaging

Misrepresentation

The best way to avoid garage misrepresentation is by merely being honest about where you park your car most of the time and always updating your address whenever you relocate.

If you drive a fuel-efficient, smart car, there are even ways that you can connect your car’s location to your insurance provider’s web system or your account with them. This is a great way to avoid unintentionally being dishonest about your garaging address and can be used in case of an emergency where you cannot tell emergency personnel your location.

Your insurance representative can give you more information on how to connect your car’s location to them or let you know if this is an option with the company. At the very least, they can give you tips on how to best keep them updated with your garaging address.

Imani Francies writes and researches for the car insurance comparison site, CarInsurance101.com. She earned a bachelor of arts in film and media and specializes in various forms of media marketing.