Your Syndicated Maps apps are indispensable, but remember to use them wisely. More and more states are tightening their laws about driving and cell phones.

Infractions can impact you in several

ways, and we will cover them, including answering the question: “Do cell phone tickets affect insurance?” We’ll

also give you several tips on how to resist distracted driving in order to

avoid a ticket.

Distracted Driving is Gaining Speed

Would you get behind the wheel wearing a blindfold? That’s essentially what you’re doing if you use your cell phone to read or send a quick text message, dial a number, or answer a call. These tasks only take a few seconds, but you could be driving the length of a football field in those few seconds if you’re driving the speed limit of 55.

Statistics

of Cell Phone-Related Driver Distraction

Taking your eyes off the road for a split-second can lead to a catastrophic accident at worst and in many cases put you in trouble with the law leading to higher car insurance rates. The statistics are staggering when it comes to distracted driving.

According to the National Highway Traffic Safety Administration (NHTSA), distracted driving claimed 2,841 lives in 2018. Among those killed were 1,730 drivers, 605 passengers, 400 pedestrians, and 77 bicyclists. That’s nearly 8 people a day.

The stats are also fearsome when it comes to teens, who were already considered high-risk drivers way before the age of hand-held technology. Six out of 10 teen crashes involve driver distraction, with 12 percent of those using a cell phone, which is why parents need to laser focus on distracted driving when they prepare their teens for driving.

Despite

all of these anxiety-inducing numbers, the warning bells about cell

phone-related driver distractions seem to be falling on deaf ears. The Insurance

Institute for Highway Safety (IIHS) estimated the number of drivers using their

cell phones jumped 57 percent from 2014 to 2018.

Punishing Distracted Driving has

Gained Traction

We are a multi-tasking, impatient society, and our cell phones have become like an appendage to us. While drivers may not be reacting to distracted driving appropriately, the government is.

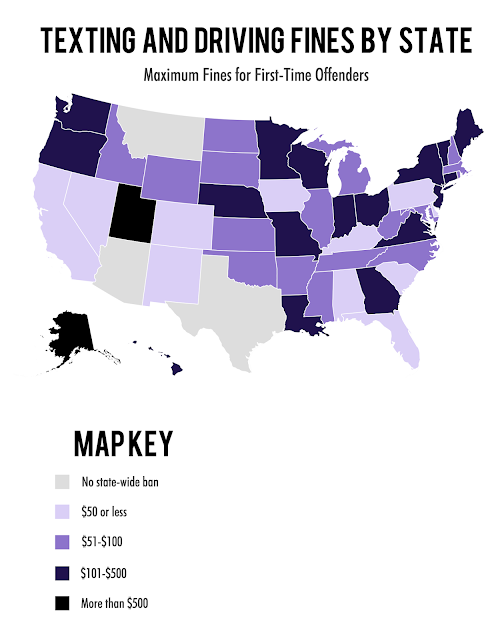

Washington was the first state to pass a texting ban in 2007. Text messaging for all drivers is banned in 48 states, D.C., Puerto Rico, Guam, and the U.S. Virgin Islands.

Additionally, 22 states, D.C., Puerto Rico, Guam and the U.S. Virgin Islands prohibit all drivers from using handheld cell phones while driving. This is considered a primary enforcement law, meaning the officer may cite a driver for using a handheld cell phone without any other traffic offense taking place.

As for laws concerning all cell phone use, no state bans all cell phone use for all drivers, but 37 states and D.C. ban all cell phone use by novice drivers. Also, 23 states and D.C. prohibit all cell phone use for school bus drivers.

Penalties for Cell Phone Use

Penalties for using your cell phone while driving vary from state to state. Expect at least a fine if you’re caught sending a text while driving. If you get ticketed in New York State, you can face a fine of $50-200 if it’s your first time. If it happens to you again, the fine increases.

Texting while driving is considered a moving

traffic violation and may be a criminal misdemeanor in certain jurisdictions.

For example, in Utah, in addition to being fined as much as $750 for your first offense, you will also be penalized 50 points on your driver’s license, and in Utah, 200 points in three years can result in a license suspension.

Insurance and Distracted Driving

Your driving history is one of the factors used to determine your car insurance rate. So when an underwriter finds a ticket for texting while driving on your motor vehicle report, you will most likely see your rate rise when you renew.

And you will be paying for that lapse in

judgment for as long as that ticket stays on your driving record, usually three

years but sometimes up to five years. If you keep a spotless record during that

time, your insurance rate will go back down.

How Much Distracted Driving

Affects Your Insurance

Your rate increase will depend on your state and on your car insurance company.

Car insurance companies have been mirroring states by raising the penalty for distracted driving. In 2011, it was only a .2 percent increase for those caught texting or talking on a cell phone while driving. By 2018, it skyrocketed to an average of 16 percent. That’s an annual increase of $226.

And if you think that’s high, there are at

least 10 states in which your car insurance rate will increase anywhere from 25

percent or $236 annually up to 41 percent or $425 annually.

How Much an Accident Affects Your

Insurance

If your distracted driving causes an accident, you could be in even bigger trouble.

Be proactive and check with your car insurance

company to see if your policy includes accident forgiveness. You will typically

have to pay extra for it, and it is not available in all states. So most

drivers don’t opt for it, unless they are a high-risk driver.

But if you are a qualified driver with a good record, your insurance company many offer it as a free perk. However, accident forgiveness usually only applies to your first at-fault accident and only if your driving record is otherwise clean.

Plus, you can’t buy accident forgiveness for an accident you already had. And you won’t be eligible to buy accident forgiveness if you recently caused an accident. If you don’t have accident forgiveness and your driving record isn’t exactly spotless, even a minor accident can raise your rates.

In states which are not no-fault, there can be a big difference regarding your insurance between if you are at-fault for an accident or not. If you’re at fault, your premium could rise by up to $138 a month. If there is a dispute with the other party regarding fault and any insurance companies need additional proof, here is how to get traffic video footage.

If you live in a no-fault state, your the insurance rate is likely to increase because regardless of how minor an accident is or who is at fault, each driver’s insurance company is responsible

for covering their client’s claims.

Tips to Help You Put the Phone Down

In addition to general safety tips for driving, here are specific strategies to help you and your family and friends prevent distracted driving.

Take advantage of your vehicle if it features built-in smartphone compatibility. Car companies are integrating infotainment systems into vehicles to let drivers plugin or wirelessly connect their cell phone to vehicle entertainment and communication systems.

Many of these newer systems can be controlled using voice commands. Experimental studies have shown drivers take shorter glances away from the road and keep their eyes on the road for a greater proportion of the time when they’re interacting using voice commands overusing their hands.

Try some phone-blocking apps such as LifeSaver, Samsung’s In-Traffic Reply, DriverMode, and DriveSafe.ly, AT&T Drive Mode, Cellcontrol, and Canary. There are also safety-encouraging apps such as EverDrive, TextNinja, and SafeDrive.

You can also take advantage of the DND (Do Not

Disturb) a feature built into most cell phones.

Other Distracted Driving

Prevention Tips

●

Prevent temptation by putting your

cell phone away. Out of sight, out of mind

●

If you need directions, put the

address in your navigation app before you start driving

●

If you need to use your phone as a

navigation tool, get a phone mount and position it at eye level

●

Pull off the road safety and stop

first, if you must call or text while driving

●

Don’t call or text someone that

you know is driving

●

Let the person with you help you

navigate, make a call, or send a message

●

Speak up if the driver of your

vehicle is distracted